Your Trusted Partner In Real Estate Transactions

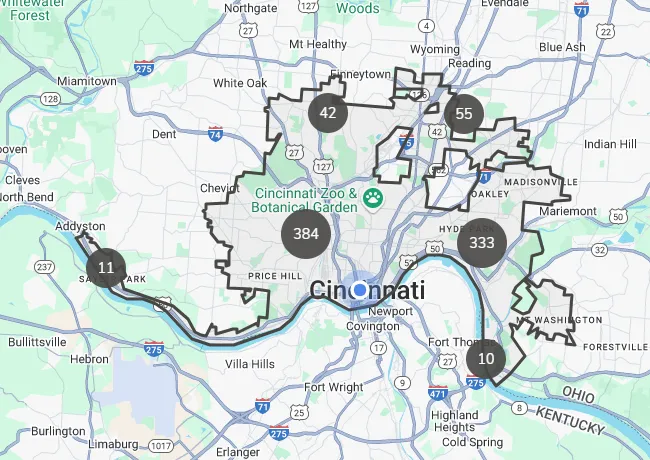

Sibcy Cline Search Tool

Unlike well-known search platforms, this tool is updated throughout the day, ensuring you get the most accurate and up-to-date property listings.

Seach using the criteria bar to filter your property search or use the map to focus in on an area of town.

Real in Cincy Blog

How to Pick the Perfect Lender for Your Home Purchase

Choosing the right lender is a crucial part of the home buying process. The right lender can make your experience smooth and stress-free, while the wrong choice can lead to delays, unexpected costs, and frustration. With so many lending options available, it’s essential to know what to look for and how to compare lenders to find the perfect fit for your needs.

It’s essential to begin the process of finding a lender well before you plan to purchase a home. A lender can offer valuable insights on improving your credit, helping you qualify for better loan terms and lower interest rates. Since these improvements can take a few months, starting early ensures you’ll be financially prepared when the time comes to buy. If homeownership is on your horizon, there’s no such thing as too soon when it comes to exploring your financing options.

Understanding the Role of a Mortgage Lender

A mortgage lender is a financial institution or individual that provides loans to buyers for purchasing homes. They determine how much you qualify for, the interest rate you’ll pay, and the loan terms. Some lenders work directly with borrowers, while others operate through mortgage brokers who act as intermediaries. Understanding the different types of lenders can help you make a more informed decision.

Types of Mortgage Lenders

There are various types of mortgage lenders, each offering different benefits and loan options. Here are the main categories:

Traditional Banks – These well-established institutions provide a variety of loan products, often with competitive rates. If you already have an account with a bank, you may qualify for special rates or perks.

Credit Unions – Credit unions are member-owned financial institutions that often offer lower rates and fees. If you’re a member of a credit union, this could be a great option.

Mortgage Brokers – Brokers don’t lend money directly but work with multiple lenders to find the best loan for your situation. They can save you time by shopping around on your behalf.

Online Lenders – Digital lenders offer convenience and often lower costs due to reduced overhead. They may have faster approval processes but may lack personalized service.

Private Lenders – Some buyers, particularly those with unique financial situations, may consider private lenders or hard money lenders. These typically have higher interest rates but offer flexibility for borrowers who may not qualify for traditional loans.

Steps to Finding the Right Lender

1. Assess Your Financial Situation

Before choosing a lender, take a close look at your financial health. Review your credit score, debt-to-income ratio, and savings. A strong financial profile can help you secure better loan terms and interest rates. If your credit score needs improvement, consider taking steps to boost it before applying for a mortgage.

2. Determine Your Loan Needs

Different loans cater to different needs. Consider factors like:

Loan Type – Conventional, FHA, VA, or USDA loans all have different requirements and benefits.

Loan Term – A 15-year mortgage has higher monthly payments but saves on interest, while a 30-year loan has lower payments but costs more over time.

Down Payment Requirements – Some loans require as little as 3% down, while others may need 20% or more.

3. Compare Interest Rates and Loan Terms

Interest rates can vary significantly from one lender to another. Even a small difference in rates can translate into thousands of dollars over the life of your loan. Get quotes from multiple lenders and compare:

Fixed vs. adjustable-rate mortgages

Loan origination fees

Closing costs

Prepayment penalties

4. Check Lender Reputation and Reviews

Look at online reviews, Better Business Bureau ratings, and personal recommendations to assess lender reputation. A lender with excellent customer service and transparency can make the process much smoother.

5. Get Pre-Approved

A pre-approval letter shows sellers you’re a serious buyer and gives you a clear understanding of how much you can afford. Compare pre-approval offers to see which lender provides the best terms.

6. Ask the Right Questions

When speaking with potential lenders, ask:

What are your current interest rates?

What fees should I expect?

How long does the approval process take?

Do you offer rate locks?

Are there any penalties for early repayment?

Red Flags to Watch Out For

High Fees and Hidden Costs – Make sure all fees are clearly disclosed.

Unresponsive Customer Service – If a lender is difficult to reach, it may be a sign of future communication issues.

Pressure to Borrow More Than You Can Afford – A reputable lender should focus on what’s best for you, not just maximizing loan amounts.

Final Thoughts

Picking the perfect lender is just as important as finding the right home. By doing your research, comparing options, and asking the right questions, you can secure a loan that fits your financial goals. Take your time, read the fine print, and work with a lender who prioritizes transparency and excellent service. A great lender will not only help you buy a home but will also set you up for long-term financial success.

If you need a lender recommendation, feel free to give me a call. I have great professionals waiting to work with you! 513-998-5858

Get the Sibcy Cline Local Events delivered to your inbox each month.

I Consent to Receive the Sibcy Cline Local Events Monthly Update & occasional marketing communication from Kim Douthit, Realtor. Message & data rates may apply. You can reply END to unsubscribe at any time.

TESTIMONIALS

"It was incredible to have the opportunity to work with Kim on finding and purchasing my first home! She was thorough and dedicated every step of the process. Every home we wanted to look at Kim found a way to get us a showing in a timely manner and exercised patience and understanding of the qualities we were looking for. She kept us informed and has checked in on us multiple times after our purchase to ensure everything went smoothly and that we are all settled in." Carmen C.

"Kim Douthit is a very nice and professional person! She was always on time at any house showing, at any time of the day. She was definitely up front and straight up honest on everything. Kim helped me in all aspects of getting into my house. She worked very well with the mortgage company and with all other parties involved. Kim was there for me all the way to closing day and she was right there with my wife and I at the signing of the closing papers." Charles E.

"She gave us advice we desperately needed, being first time home buyers. Kim took on the fast paced market and got us showings, one after another. These showings were essential for us to make our decision before any competition came in." Angus H.

AT THE HEART OF ALL GREAT MOVES

Sibcy Cline Insurance Services insures thousands of people in our region ... and have exceptional service ratings and a simple quoting process.

Let Sibcy Cline Home Services handle the heavy lifting with inspections and contractors so that you can focus on your next big adventure!

Loan officers with Sibcy Cline Mortgage Services work side by side with us from the beginning of your home search to the closing table.

When issues show up in a title search, an expert from Sibcy Cline Title Services is there to clear them up before they interfere with financing or closings.

Get started today!

Connect with me to get answers to all your questions. you can call or email me.