Your Trusted Partner In Real Estate Transactions

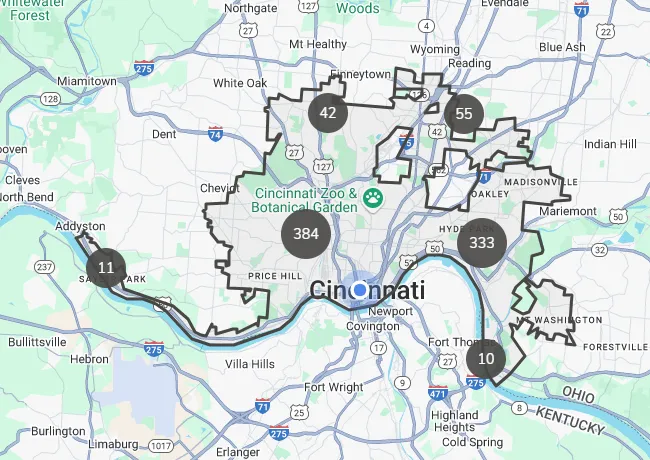

Sibcy Cline Search Tool

Unlike well-known search platforms, this tool is updated throughout the day, ensuring you get the most accurate and up-to-date property listings.

Seach using the criteria bar to filter your property search or use the map to focus in on an area of town.

Real in Cincy Blog

New Blog Post

What Are Mortgage Rates Doing Now?

The 30-year fixed mortgage averaged 6.67% as of July 3, 2025—its lowest level since April, and a five-week decline from 6.77% the prior week freddiemac.com+4apnews.com+4themortgagereports.com+4.

The 15-year fixed rate also eased, now around 5.80%, down from 5.89% apnews.com+1themortgagereports.com+1.

Bankrate reports a current average of 6.68% for 30-year fixed and 6.00% on a 15-year en.wikipedia.org+15bankrate.com+15themortgagereports.com+15.

🤔 Why Rates Are Still High

Federal Reserve Policy

Despite strong job growth—147,000 added in June and unemployment ticking down—Federal Reserve Chair Powell left no hint of imminent rate cuts investopedia.com+6businessinsider.com+6marketwatch.com+6.

The Fed’s benchmark funds rate now sits around 4.33%, and tied mortgage rates remain elevated nypost.com+3apnews.com+3marketwatch.com+3.Bond Market Dynamics

Mortgage rates are influenced not just by Fed policy, but by 10-year Treasury yields. Currently hovering around 4.25%–4.33%, those yields have kept mortgage rates anchored in the high 6% range.Structural Affordability Challenges

Even if rates dip slightly, housing affordability will remain tight due to:Limited inventory and persistent home shortages (~4 million homes short) marketwatch.com+5freddiemac.com+5themortgagereports.com+5

Rising mortgage insurance and insurance costs bankrate.com+4ycharts.com+4bankofamerica.com+4

🏠 Market Impact & Forecasts

Buyers are starting to re-enter the market: pending home sales rose 1.8% in May as rates dipped apnews.com+1wsj.com+1.

Recent weeks have seen more homes on the market, and sellers are offering rate buydowns to compensate for high rates marketwatch.com+1wsj.com+1.

Forecasts for late 2025 into 2026 expect rates to stay in the 6.4%–6.8% range, according to Fannie Mae, NAR, and Wells Fargo finance.yahoo.com+7themortgagereports.com+7apnews.com+7.

J.P. Morgan predicts rates will remain above 6.5% through 2025 forbes.com.

✅ What This Means for You

Rates in the high 6s are now the “new normal”. They’ve softened a bit but won’t fall back to sub-4% anytime soon.

For buyers: Dropping rates and more inventory mean improved negotiating power. But affordability still requires careful planning.

Getting pre-approved now locks your payment even if rates rise before closing.

For homeowners with high mortgage rates (>6.5%): Most don’t qualify to refinance yet unless rates dip meaningfully—and that’s uncertain.

🔑 Bottom Line

Yes, mortgage rates have eased—but they’re still strong by historical standards. If you're ready to buy, now may be the time to act: rates aren’t likely to plummet, and conditions favor serious buyers. Just be prepared with a smart budget and a pre-approval in hand.📈

Get the Sibcy Cline Local Events delivered to your inbox each month.

I Consent to Receive the Sibcy Cline Local Events Monthly Update & occasional marketing communication from Kim Douthit, Realtor. Message & data rates may apply. You can reply END to unsubscribe at any time.

TESTIMONIALS

"It was incredible to have the opportunity to work with Kim on finding and purchasing my first home! She was thorough and dedicated every step of the process. Every home we wanted to look at Kim found a way to get us a showing in a timely manner and exercised patience and understanding of the qualities we were looking for. She kept us informed and has checked in on us multiple times after our purchase to ensure everything went smoothly and that we are all settled in." Carmen C.

"Kim Douthit is a very nice and professional person! She was always on time at any house showing, at any time of the day. She was definitely up front and straight up honest on everything. Kim helped me in all aspects of getting into my house. She worked very well with the mortgage company and with all other parties involved. Kim was there for me all the way to closing day and she was right there with my wife and I at the signing of the closing papers." Charles E.

"She gave us advice we desperately needed, being first time home buyers. Kim took on the fast paced market and got us showings, one after another. These showings were essential for us to make our decision before any competition came in." Angus H.

AT THE HEART OF ALL GREAT MOVES

Sibcy Cline Insurance Services insures thousands of people in our region ... and have exceptional service ratings and a simple quoting process.

Let Sibcy Cline Home Services handle the heavy lifting with inspections and contractors so that you can focus on your next big adventure!

Loan officers with Sibcy Cline Mortgage Services work side by side with us from the beginning of your home search to the closing table.

When issues show up in a title search, an expert from Sibcy Cline Title Services is there to clear them up before they interfere with financing or closings.

Get started today!

Connect with me to get answers to all your questions. you can call or email me.