Seller Incentives That Actually Entice Buyers

Seller Incentives That Actually Entice Buyers

(And Which Ones Don’t)

In a market where buyers have more choices and affordability still matters, seller incentives are no longer a sign of weakness—they’re a strategic tool.

The mistake many sellers make is offering incentives that sound generous but don’t change buyer behavior. The incentives that work in 2026 are the ones that reduce friction, lower upfront costs, or remove uncertainty.

Below is a practical breakdown of seller incentives that truly move the needle—and how to use them correctly.

Why Seller Incentives Matter More Now

Buyers today are:

More payment-sensitive

More cautious about condition and future costs

Less willing to stretch just to “win” a home

That doesn’t mean they won’t buy. It means they’re looking for value and confidence.

Seller incentives help bridge the gap between what a buyer wants to pay and what a seller needs to net—without always cutting the price.

1. Closing Cost Credits (One of the Most Effective Incentives)

Closing cost credits remain one of the most powerful incentives because they directly reduce a buyer’s cash out of pocket.

Why buyers love this:

Less cash needed at closing

Easier approval and less financial stress

Feels immediate and tangible

How sellers should use it:

Offer a defined credit (e.g., $5,000–$10,000)

Position it as flexibility for the buyer

Pair it with a strong list price rather than slashing price upfront

Pro tip: Buyers often value a $7,500 credit more than a $7,500 price reduction because it solves a cash problem, not a long-term math problem.

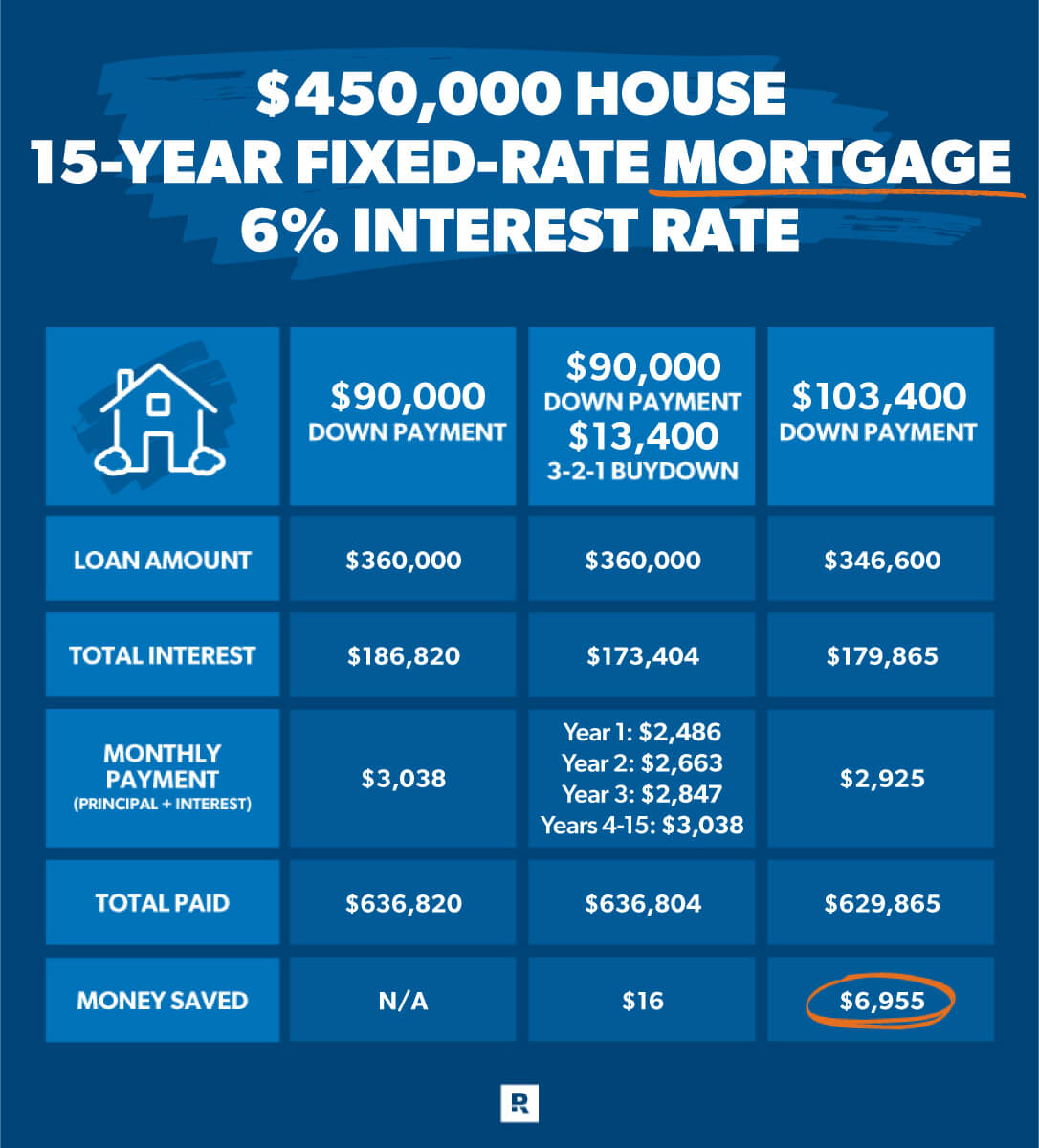

2. Interest Rate Buydowns (When Done Correctly)

Temporary or permanent rate buydowns can significantly reduce a buyer’s monthly payment—especially important in payment-conscious markets.

Common options:

2-1 or 1-0 temporary buydowns

Permanent rate reduction using seller funds

Why this works:

Buyers shop by monthly payment. A lower payment:

Expands the buyer pool

Makes higher prices feel more manageable

Reduces buyer hesitation

When this incentive works best:

When rates are elevated

When buyers are payment-constrained but motivated

When paired with a lender who explains it clearly

Important: This must be structured correctly. Vague promises about “help with rates” don’t entice buyers—clarity does.

3. Pre-Sale Repairs or Repair Credits

Buyers are far less tolerant of “projects” than they were a few years ago.

High-impact repair incentives:

Roof repairs or certification

HVAC servicing or replacement credits

Plumbing or electrical corrections

Addressing inspection red flags in advance

Why this works:

Buyers fear unknown costs more than known ones. Fixing or crediting obvious issues:

Reduces inspection fallout

Builds trust

Prevents renegotiation

Seller mindset shift:

Fixing issues before listing often results in stronger offers, not just smoother closings.

4. Home Warranties (Useful—but Limited)

Home warranties aren’t a deal-maker on their own, but they can help reduce buyer anxiety—especially for first-time buyers.

When they help:

Older homes

Entry-level price points

Nervous or inexperienced buyers

When they don’t:

Luxury properties

Buyers focused on long-term value

Situations where major systems are already questionable

Think of a home warranty as a supporting incentive, not the headline.

5. Flexible Possession or Rent-Back Options

Flexibility can be just as valuable as money.

Buyer-friendly options:

Flexible closing timelines

Seller rent-back periods

Delayed possession

Why this works:

Some buyers are juggling:

Lease endings

Job relocations

School-year timing

Meeting them halfway can push an offer over the edge—without costing the seller much.

6. Covering Transfer Taxes or Specific Fees

In certain areas, transfer taxes or specific fees catch buyers off guard.

Covering them:

Simplifies the transaction

Reduces buyer stress

Makes your offer easier to accept

This incentive works best when clearly stated and itemized.

Incentives That Don’t Entice Buyers (Most of the Time)

Not all incentives are created equal.

Low-impact or outdated incentives:

Furniture or décor credits

Vague “upgrade allowances”

Overly specific repair promises

Incentives that require complex explanations

If a buyer can’t immediately understand the benefit, it usually doesn’t move them.

Incentives vs. Price Reductions: Which Is Better?

This is one of the most common seller questions—and the answer depends on buyer psychology.

Incentives work best when:

Buyers are cash-constrained

Monthly payment is the main concern

The home is priced correctly but needs a nudge

Price reductions work best when:

There is little to no showing activity

The home is clearly overpriced

Buyer feedback consistently points to price

In many cases, a strategic incentive preserves value better than an early price cut.

How to Use Incentives Without Looking Desperate

This matters.

The most effective incentives are:

Pre-planned, not reactive

Clearly defined, not vague

Positioned as buyer-friendly, not seller-driven

Buyers respond to confidence. Incentives should feel like added value, not a concession.

The Bottom Line

Seller incentives in 2026 are not about giving money away—they’re about removing obstacles.

The best incentives:

Lower upfront costs

Reduce monthly payments

Eliminate uncertainty

Make the decision easier for the buyer

When used strategically, incentives can:

Attract more buyers

Strengthen offers

Reduce time on market

Protect your net proceeds

Thinking of a move in 2026?

Before you sign with a realtor who will default to a price reduction, let’s talk about incentive options that make sense for your home, your market, and your goals. A short conversation can help you decide what will actually entice buyers—and what you can skip.

I’m happy to discuss incentive options for your sale. Call or text.

Kim Douthit

Keller Williams Advisors

(513) 520-6091